Don’t Redeem it, Lien it Instead

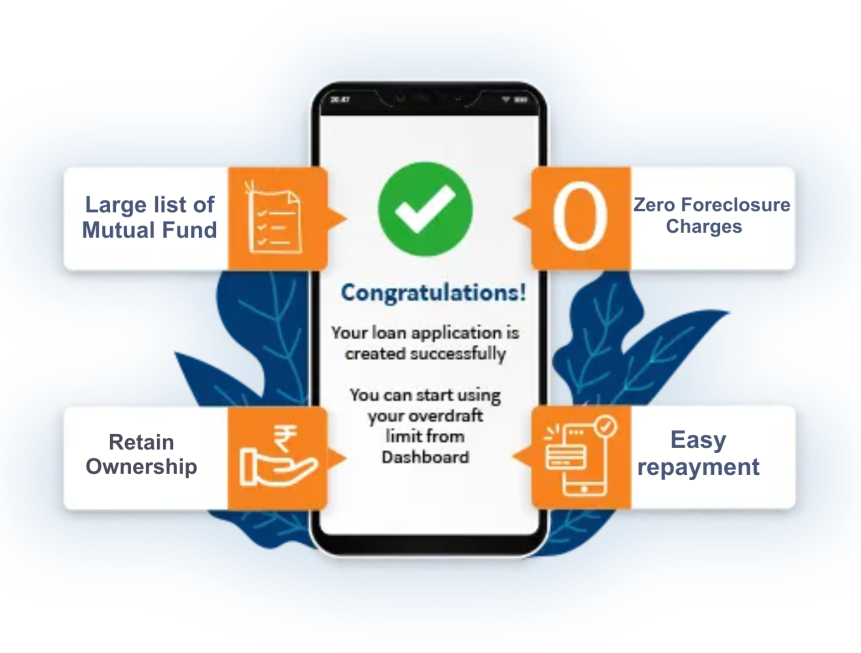

In partnership with Mirae Asset Financial Services, we offer a unique financial solution that allows your investments to work harder and smarter. By choosing our offering, you enjoy a seamless digital process, secure transactions, and the certainty of partnering with a trusted name in the investment field.

The loan is available as an overdraft facility, allowing you to access the funds you need and repay them at any time without additional charges Interest is charged only on the utilized amount and for the duration, the funds are utilized.

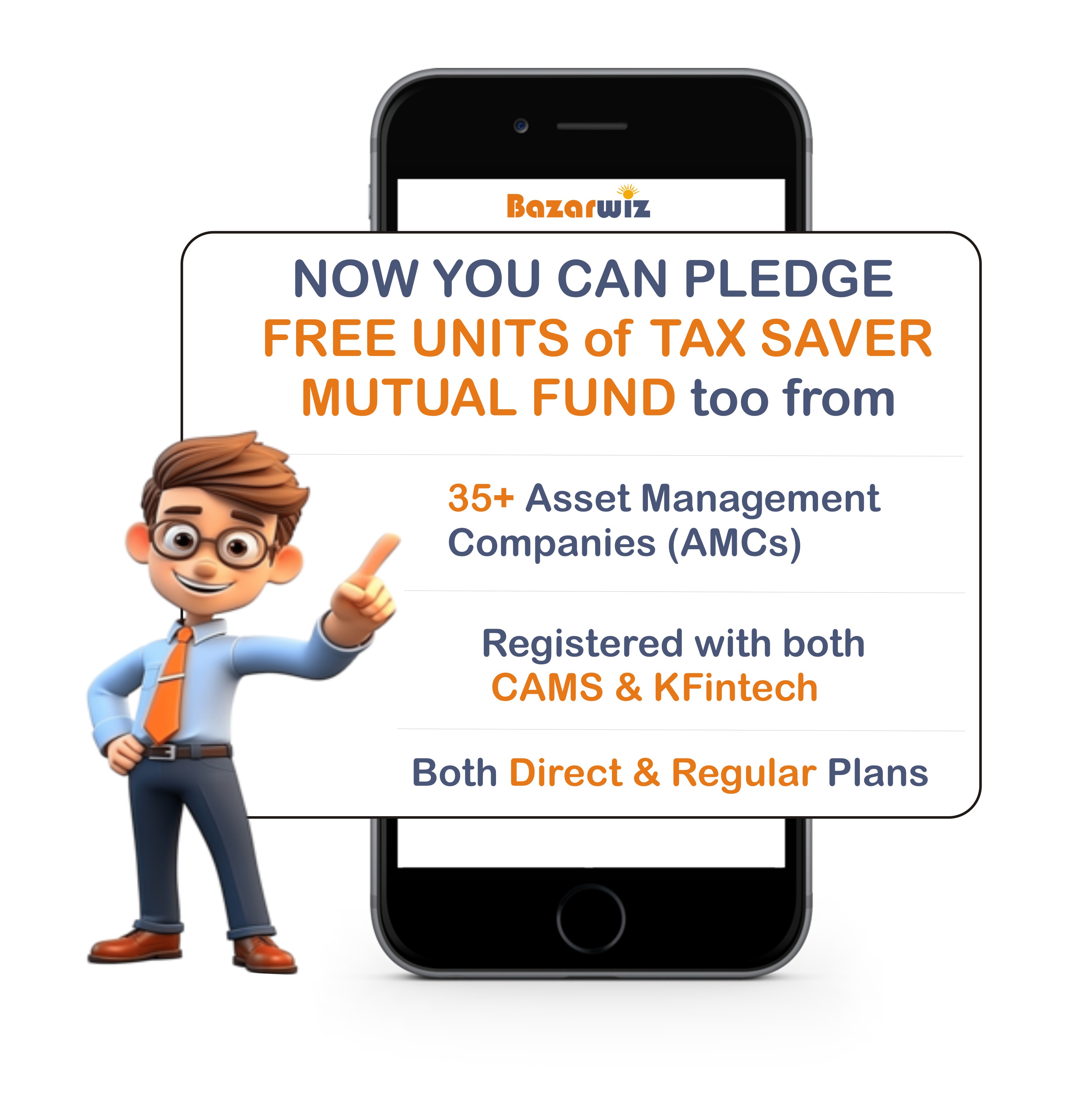

You can choose from a variety of approved mutual funds from various asset management companies (AMCs) in India and use them as collateral. To lien mark, you can use mutual funds registered with CAMS and KFintech (previously known as KARVY), Registrars & Transfer Agents (RTAs) as collateral. We suggest using a secured loan against mutual funds as a suitable option for short or medium-term financial needs.

Your path to instant liquidity is just a click away !

If a customer takes a loan of ₹50,000 for a period of 12 months, at an annual interest rate of 9% APR, then the customer will pay monthly interest for 12 months of ₹375 per month. The total loan payment over 12 months will be ₹54,500* (including principal and interest). Total Cost of Loan = Interest Amount + Processing Fees + Stamp Duty = ₹4500 + ₹999 + ₹500 = ₹5,999

Apply Via Web Download AppBy availing Loans Against Mutual Funds, you consent to our Terms & Conditions. These include: Withdrawals can be made in tranches of INR 50 lakhs. The next tranche can only be processed once the "Withdrawal Request" status is completed,The loan disbursal window operates from 8:00 am to 5:00 pm, except on bank holidays,When creating a bank mandate, ensure you have net banking and/or debit card access for the mentioned bank account. Major Banks are part of the e-Mandate, Co-operative Banks are currently not included,Interest is automatically collected every 3rd of the month via ECS. Borrowers will receive a notification on the 1st of the month to maintain a sufficient balance,Mobile number and email address can be changed online post loan creation,Any interactions for Loans Against Mutual Funds will be between the borrower and Mirae Asset Financial Services. Bazarwiz will only guide on leveraging this option and will not be liable for any issues arising from this arrangement.

Copyright © 2026 Design and developed by Fintso. All Rights Reserved